Quick Guide to Pre-Authorizations for Individual & Employer-Sponsored Health Insurance

In Triage Health's free Quick Guide to Pre-Authorizations for Individual & Employer-Sponsored Health Insurance, you'll learn what pre-authorization is, how to get it, how to file an appeal of a denial, and more!

Olivia’s doctor recommended that she get an MRI. Because MRIs were listed as a covered service in her health plan, Olivia assumed the health insurance company would cover it and got the MRI the following day. Unfortunately, Olivia’s health insurance company requires patients to get pre-authorization before getting an MRI. A few weeks after the MRI, Olivia’s insurance company told her that they would not pay for her MRI without the pre-authorization. When Olivia got the bill for the MRI, it was $1,325. Olivia’s situation is common. It is important for patients to find out if they need to get pre-authorization from an insurance company before they receive any care. This Quick Guide will explain pre-authorizations for people who have an individual or employer-sponsored health insurance plan. The details of preauthorizations are different depending on the type of plan that you have, such as Medicare, Medicaid, or a military plan.

What is a Pre-Authorization?

Health insurance companies may require you to obtain their written approval before you receive certain medical care, including specific treatments, medical devices, and prescriptions. This approval is called preauthorization, but might also be called pre-auth, prior authorization, prior auth, prior approval, precertification, treatment authorization request, or advanced approval.

Insurance companies are not required to pay for medical care that requires pre-authorization, if a patient receives these services without the pre-authorization. Patients may then have to pay the full cost of the medical care. Medical care that might require pre-authorization includes:

- Medical treatments that have lower-cost, but equally effective, alternatives available

- Medical treatments and medications that should only be used for certain health conditions

- Lab tests, imaging scans, and biomarker tests

- Medical treatments and medications that are often misused or abused

- Medications that may be unsafe when combined with other medications

- Drugs often used for cosmetic purposes

- Medical care that is provided out-of-network

Most insurance companies do not provide a list with the medical care that requires a pre-authorization, so you have to ask. Your insurance company may also change its pre-authorization requirements at any time.

Sometimes, your health care team will request a pre-authorization for you. But if they don’t, and you get the medical care without the pre-authorization, then your insurance company may refuse to pay for the care.

Ultimately, it is the patient’s responsibility to get the pre-authorization. This means that it is always helpful to ask your health care team if they will be getting any necessary pre-authorizations for you. If they aren’t, then you need to get the pre-authorization from your insurance company.

How to Get a Pre-Authorization?

- Find out if your medical care needs a pre-authorization:

- Contact your health insurance company to find out if the care you need requires pre-authorization.

- If it does, then ask your health insurance company about their process to get a pre-authorization.

- Find out if your health care team will request the pre-authorization:

- Contact your health care team to find out if they will request the pre- authorization from your insurance company, or if you will have to do that.

- Complete and submit your forms on time:

- Many insurance companies require you to complete pre-authorization forms by certain deadlines. Make sure that you are going through the pre-authorization process as early as you can, so that waiting for a pre-authorization doesn’t delay your medical care.

- Keep good records:

- When you submit your pre-authorization form, make sure that you keep a copy, in case your request is lost. If you can get a time-stamp, or email confirmation that you sent the form in. If your pre-authorization is approved, make sure that you keep that paperwork in a safe place, in case your insurance company later tells you that they did not approve the pre-authorization.

- Appeal the denial of any pre-authorizations:

- If your health insurance company denies a pre-authorization, meaning that they are saying they will not cover the care prescribed by your health care team, you do not have to take no for an answer. You can appeal that decision.

How to Appeal a Pre-Authorization Denial?

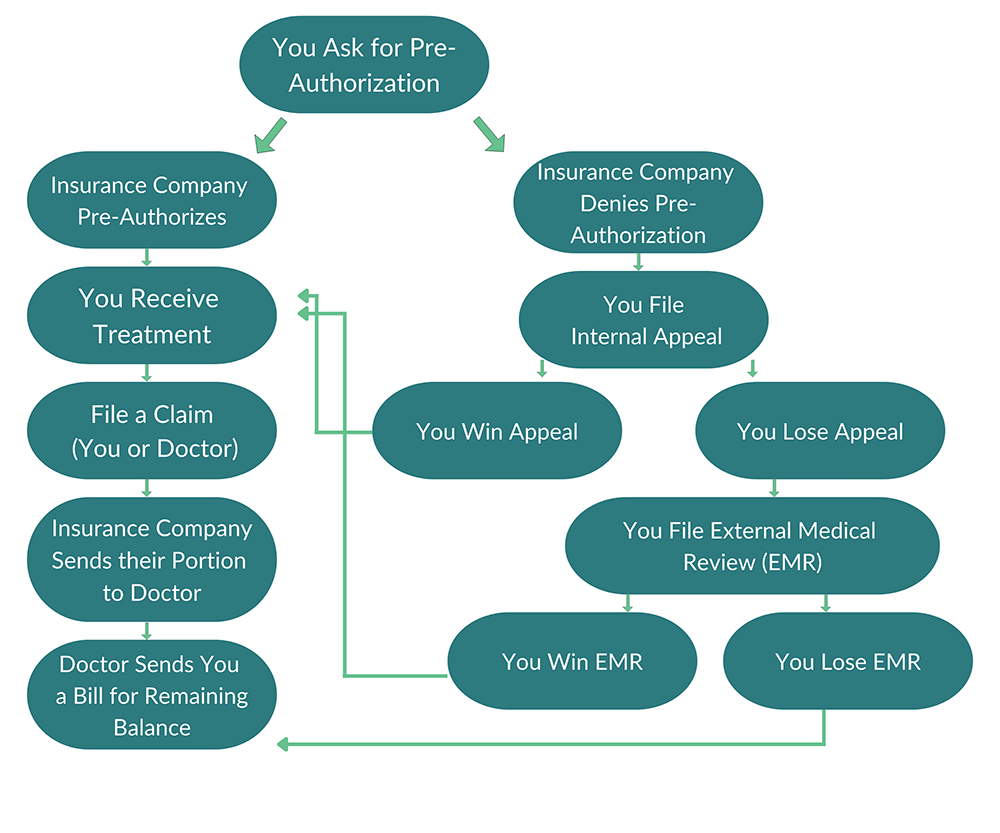

You generally have two chances to appeal a denial of coverage: an internal appeal and an external appeal.

Internal Appeals:

When an insurance company has denied coverage for care, you can file an “internal appeal” within your insurance company. Each insurance company has its own internal appeals process, so contact your insurance company for details or look for instructions on how to file an appeal on your denial letter. Make sure to follow any deadlines for filing an internal appeal.

If your insurance company denies your internal appeal, you can request an external appeal. Under the Affordable Care Act, all states must have an external appeals process – this is also sometimes referred to as External Medical Review or Independent Medical Review.

External Appeals:

Within four months of receiving your insurance company’s denial of your internal appeal, you can file a written external appeal (note some states provide additional time). External appeals must be completed within 45 days of filing and the decision is binding on the insurance company. If the medical care is urgent, external appeals can be expedited, filed at the same time as an internal appeal, and decided within 72 hours. State insurance agencies or the U.S. Dept. of Health & Human Services handle external appeals. The HHS process is free, but states can’t charge more than $25 for an external appeal.

For more information on appeals, visit our Health Insurance Materials & Resources, and our Cancer Finances module on Appeals.

Learn More

For more information about pre-authorizations, see our Health Insurance Materials & Resources.

Sharing Our Quick Guides

We're glad you found this resource helpful! Please feel free to share this resource with your communities or to post a link on your organization's website. If you are a health care professional, we provide free, bulk copies of many of our resources. To make a request, visit TriageHealth.org/MaterialRequest.

However, this content may not be reproduced, in whole or in part, without the express permission of Triage Cancer. Please email us at TriageHealth@TriageCancer.org to request permission.

Last reviewed for updates: 01/2022

Disclaimer: This handout is intended to provide general information on the topics presented. It is provided with the understanding that Triage Cancer is not engaged in rendering any legal, medical, or professional services by its publication or distribution. Although this content was reviewed by a professional, it should not be used as a substitute for professional services. © Triage Cancer 2023